Open a Company in Vietnam for Foreigners

Open a Company in Vietnam for Foreigners ? Understanding the actual step-by-step will help your business launch easier. Here are the details on requirements, procedures, and costs in order to open a Vietnam company as a foreign investor.

Open a Company in Vietnam for Foreigners

Requirements to Open a Company in Vietnam

Before starting your company in Vietnam, you need to check the list of conditions below:

- Business Conditions

- Investment Capital

- Business Address

- Company Structure

- Legal Representative

- Required Documents

Business Conditions

Vietnam is not a fully open market for foreign investors. So in the beginning, you need to consult with your lawyers to understand all local conditions to kickstart and run your business in Vietnam. Here are some of the business activities that foreigners can easily do in Vietnam:

- Import, Export

- Wholesale Distribution

- Business Consulting

- IT Services

Sources:

- https://vietnaminvest.gov.vn/SitePages/News_Detail.aspx?ChuyenMuc=3&ItemId=16

- https://dangkykinhdoanh.gov.vn/vn/Pages/Nganhnghedautukinhdoanh.aspx?lvID=4

#2. Investment Capital

Each company in Vietnam needs to declare and deposit an amount of capital.

Technically, there are no regulations on a minimum capital requirement, except in some specific industries. In practice, the local licensing authority will closely examine and assess your proposed registered capital, based on the nature of your business activities and project scale. It will be determined on a case-by-case basis.

In addition, the more capital contribution, the longer-term visa will be granted to investors.

#3. Business Address

You must have a company address in Vietnam as the registered office and principal place of business (in accordance with Article 38 of the Law on Investment 2020)

In general, the best location to register your company is the one you will be conducting most of your business. It is highly advisable that you come for an on-site visit to make sure a location is the best fit for your business.

#4. Company Structures

In Vietnam, there are main 3 types of company structures that foreign investors can choose from:

Open a Company in Vietnam for Foreigners

Choosing which company structure to establish is very simple. It depends on the number of investors and the management structure you require. For example, an LLC is the best fit for small and medium businesses due to its simple management structure and lower corporate compliance costs.

In addition, the regulations here in Vietnam do not differentiate the tax treatment based on the structure of companies.

#5. Legal Representative

The legal representative is the individual who represents the company to exercise the rights and obligations arising from the company’s transactions, according to Article 12 of the Enterprise Law 2020.

A Vietnam company may have more than one legal representative. One of them needs to stay in Vietnam. Hiring a local legal representative is certainly not required by law, it is absolutely up to your business demand. A company’s legal representative may take the title of Director, General Director, CEO, CFO, President, etc.

#6. Required Documents

The foreign investors will be required to provide the below documents. In addition, documents of the corporate investor (i.e. company registration certificate) are subject to the Vietnam longer visa and notarization process.

| INDIVIDUAL INVESTOR | CORPORATE INVESTOR |

|---|---|

| Passports of all investors | – Company Registration Certificate – Passport/ID Card of authorized representative(s) of the Investor |

| Bank Account Statement (Note: The account’s balance must be equal to or more than the value of the declared capital) |

Financial Statement of the 02 latest FS years. |

| Lease Contract and its legal documentation related to the business address | Lease Contract and its legal documentation related to the business address |

How to Open a Company in Vietnam

In order to set up a company, it is necessary to follow 5 steps:

- Step 1. Rent a Business Location

- Step 2. Prepare Required Documents

- Step 3. Register a Company

- Step 4. Open Local Banks Accounts

- Step 5. Apply for Licences/Permits (if required)

Let’s take a closer look at each of these steps.

Step 1. Rent a Business Location Open a Company in Vietnam for Foreigners

You will need to find a suitable address for your company, then sign a lease contract with the landlord. Next, you need to request the landlord to provide related legal documents related, such as a certificate of land right use.

Step 2. Prepare Required Documents

Per your lawyer’s suggestions, you will then begin to compile all necessary documentation, notarize it, and translate them into Vietnamese. The lawyer will prepare full application forms which need your signature and stamp (if any).

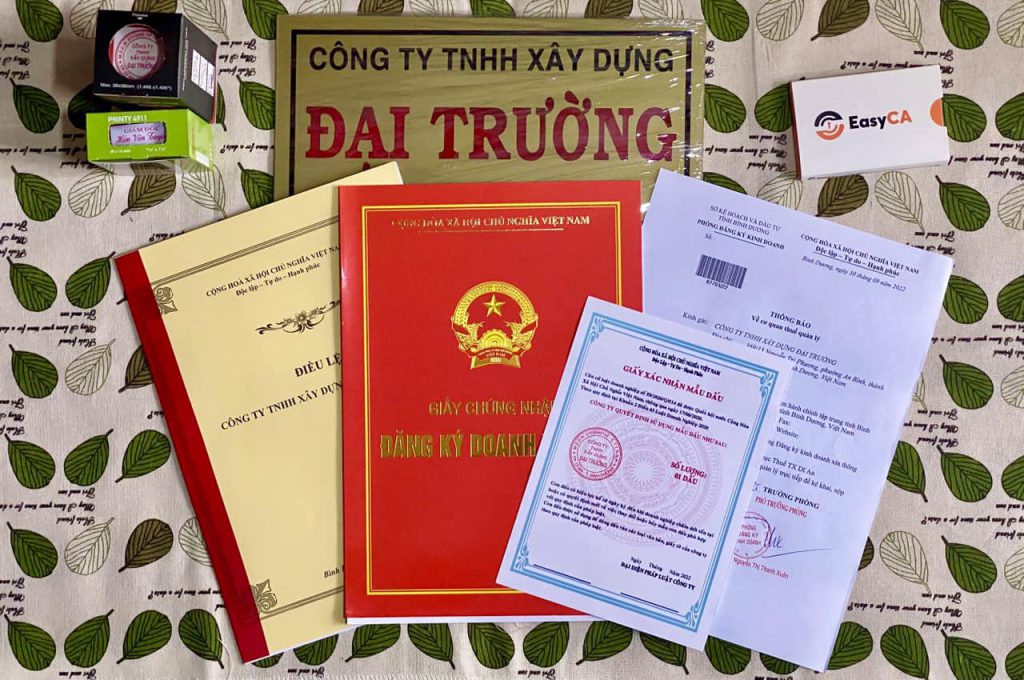

Step 3. Register a Company

Including 2 sub-steps:

- File for an Investment Registration Certificate: takes from 15 working days

- File for an Enterprise Registration Certificate: takes from 05 working days

At this point, your hired legal team will take over and handle all of the administrative, legal, and communication with local authorities. Make sure your legal team provides accurate communication and detailed updates on your company registration progress.

Step 4. Open Local Bank Accounts

Once your company is established, you will need to open at least 2 bank accounts:

- A Direct Investment Capital Account, or D.I.C.A, is used to make transactions related to your investments in Vietnam, such as receiving the contributed capital and transferring the profit to your home country. (Please note that the contributed capital needs to be transferred to this account within 90 days of company establishment).

- A Payment Account, which will be used for the company’s daily activities, such as contract, salary, and tax payments

Step 5. Apply for Licences/Permits (if required)

Before performing any conditional business/industry, your Vietnam company must apply and obtain the required licenses or permits (see requirement #1 mentioned above).

How Much to Open a Company in Vietnam for Foreigners ?

The minimum actual cost to set up a Vietnam company is approximately USD 5,290 for the first year of operation. Most of which is allocated to rent the business location, related incorporation services, and post-incorporation compliance fees.

| Items | Descriptions | Minimum Costs |

| Yearly registered address |

|

$970 |

| Company formation |

|

$1,700 |

| Post-incorporation compliance |

|

$320 |

| Accounting compliance (12 months) |

|

$1,500 |

| Business Visa and Work Permit |

|

$800 |

| TOTAL (minimum cost for the first year of operation) | $5,290 | |

Navigating through all the documents and requirements when opening a company in Vietnam can be quite a headache and time-consuming. Visa Thai Duong Vietnam is here to help!

We have been assisting foreign investors in setting up businesses in Vietnam for years. Visa Thai Duong offers a wide range of business legal services: Legal Consulting, Company Registration, Licensing, Visas, and more. Contact our lawyers to register your Vietnam company today!